C. Money Management

Most of the books I have read put this part at the end of the book. I regard this subject as way to important and have put it before the system itself is explained. This is

the Work Procedure Section that will outline most of the factors that will have an influence on the outcome of your trading. Before we will proceed to the actual MLTS system explanation you will have already set certain parameters according to your specific circumstances and needs that will already give you an edge.

Tsunami

This is the most important part of the whole document. This is the concept of the money changers. Now I am no financial expert but I will put it on paper as I understand it and as I have experienced it. The money changers or “mafia” as I call them goes about in cycles and only the length and severity of the cycles differ from one another. The concept stays the same. And what is amazing is the fact that the reporting part by the media has not changed ever since. There reporting (and they are supplied with this info by the mafia) have not change either. When the going is good there reporting even shows a better picture. When the going gets bad there reporting shows even worse times to come.

Like the crash we just had in 2008. When the markets turned around in March2009 slowly creeping upwards nobody(or only a few) exploit that. The market was going up but the reporting was bad times to come. While the world was waiting for the worst to come the mafia has position themselves to take advantage of the fear that was created. They accumulated while the rest was selling out of fear and panic fueled by the bad media reports. Even today with the markets being more then 75% up from its low the reports are still bad news. Now that does not make sense. There might be still a bad time ahead. But currently the markets are moving upwards. I have a saying I always use “The facts are in front of me, therefore I will do This and That”. Watch when their reporting change to buy mode. Then the move is close to over. I am going to present it this way. I am sitting on the beach with my back to the ocean relaxing in the sun and there are people playing and running around etc. They are all playing on the beach. The fact that people run around does not make me nervous but it is when there is a different kind of behavior in their running that calls my attention. I will most definitely see in their faces and emotion that there is a reason for their running. I have five things that I can do.

Firstly I can be a nervous sunbather and jump up every time someone comes running past only to find that it is trying to catch a running ball. Nothing serious. That is how 90% of people do there trading. Jumping after every move only to find it was normal zig zag movements and their stoploss get hit frequently. They get wiped out very quick. Secondly I can put on my dark glasses put on some sun tan lotion and ignore the running at all as I am covered. These people put in their deal go fishing and looks after two days how did it goes. Sometimes it works sometimes it doesn’t. After a year of trading they find themselves round about breakeven. If they have a good solid strategy they make conservative gains which is less stressful. But there is more of the cookie to take advantage of. Thirdly there are those that wants to investigate everything in detail as to why. By the time they found out why are the people running they got hit by a tsunami. By the time you found out why the market is running it is to late as it is about to turn around again. They always time the top or bottom but in the wrong direction. You get people that is always late. They get wiped out very quickly.

Fourthly you get those that ran along the moment there is some action going on.

This group does make some profit but it is nervous profit. I call them the news traders.

With time (some accounts does not last till then) you can become good at it, but it is due to experience. It is very nervous money made. Let me explain to you the concept of the money changers and there actions. When

interest rates comes down due to good economic condition these people send out all sorts

of ways how to lend cheap money for that trip overseas, new car etc. etc. Till the money

availability gets low and spending is sky-high due to the easy way to get money. Then the

interest rate is raised by 0.5% and after a month another 0.5% and so on. More money out

of the pocket of the consumer that he has to pay back than what he has budgeted for.

Troubled times!!!!!!!!!. They are collecting till the cycle turns again and then it is

lending out again. When does the local mafia with its Ferrari come to make you an offer

for your house. When the market is at its peak or when you cannot pay back the loan.

They will even make you feel that they actually give you a better price then what you

should have got. Shame!!

There are those that invites you to come and play on the beach of Forex trading

knowing that a tsunami will hit some or other time. All these how to make a million in a

couple of months sort of advertisements. All they have to do is get as many people on

that beach while they are playing around with them and over time they pass the ball into

the hands of the majority but when the signs of a tsunami is nearing they are the first ones

to leave without the majority noticing it because they are busy playing. Only there

followers knows. When troubled times are coming the informed are the first to leave the

beach.

When the tsunami hits they have their deals in to take advantage of the panic

selling of the masses. They created it beforehand. Not the tsunami but the playing field

conditions. They know what the reaction of the masses and uninformed is when a

tsunami hits the beach. They have done it millions of times in the past. Spreading some

news here and there that they know the masses will react upon and so setup the whole

scene. When the masses are buying you should be selling and visa versa. That is

what a well known speaker and investor says “to step into the pain”. To buy when the

price has dropped and the mafia are busy accumulating or to sell when the mafia is busy

distributing. That is to move with the mafia.

We as tiny investors does not have the resources to step into that pain as it means

waiting for some time before the bubble burst and our capital cannot handle those type of

stoplosses as they must be huge to handle the playing area of those on the beach. The

money changers can handle that, They will sit for months and knows that the coming

tsunami will make them rich.

Fifthly I can watch the faces of those that handed out the balls. If they can be

identified. They normally have followers that do their job for them. Reporting some nice

sunny days to come with some more money to be made. They don’t create a sudden flow

of sell orders but with the nice media reports they just feed the market with enough sell

orders as there is buyers for. That is how they get rid of their positions. Their emotion

will tell the overall status. The big ones leave the scene unnoticeable to the majority. It is

only when there followers see they are not there anymore that they started to react. It is

at this point where you as part of that 5% must step in. Recognizing the changing

emotion and run with them. You might not know why you are running yet but that you

will read in the papers and not others reading about you in the papers.

There are certain signs that we can use to see the actions of the mafia. We are

going to look into that in detail when explaining the MLTS system. That will prepare us

for the coming tsunami. We will have a definite plan in place with solid foundational

rules to take advantage of the coming move. We will run with them. That is the key to

survival. There are specific places that they get involve in the markets. We will exploit

that in the MLTS. You have different stages of a big move. The original start of a move is

not always spotted sometimes leaving a lot of traders behind. But there is always certain

places to hop on board. That is the main ingredients of the MLTS system. To hop on

board at a certain place that is affordable for us and to stay with the move as long as

possible if we miss the first stage of the move.

It is amazing how they sometimes start a move on a Friday afternoon just before

closing time knowing that we as tiny traders don’t leave trades open over weekends. And

then they gap it on Sunday nights. But with the MLTS that wont bother us. We will have

a plan in place to get on board.

Compounding

One of the most powerful tools that is overlooked is the power of compounding.

We are too focused on big gains now that we forget the path of steady gains reinvested

that will produce massive accounts over time. Our eagerness or greed to make huge gains

most of the time puts us in reverse mode and making other people rich that knows the

road to patience using our money to do so with compounding over time. When you look

at the power of compounding you can decide upon a route that will suit your account size

and also not to expect gains that is not achievable.

Look what can be achieved after 25years when $50000 capital is invested with a

22% after tax growth per year and $50 added each month for the first year and then

thereafter increased by 5% per year. You can alter the Initial Deposit to $5000 or $500

and then by dividing the Total by 10 or 100 to see what the corresponding result will be

with less investment.

the people promoting systems and or strategies promising these huge gains that are not

sustainable over time. On my website www.phillipnel.co.za I also have potential gains

that were huge when I started due to the credit crunch of 2008 and the volatility was

huge. But that have reduced dramatically since the markets have moved back into

normality. One must never mistaken brilliance with a strong bull or bear run.

Everyone can make money when the market is on a run and that has very little to do with

the expertise of the trader. The question is can you sustain these actions in a constant

flow of positive money. That is what it is all about.

Another question is the old monster of account size. How much money do I need

to trade. You can start nowadays with as little as $50 on a nano account. That is a tenth of

a micro account that needs about $250 and a full account that needs about $2500. You

can make money on all these accounts. The question is HOW MUCH DO YOU WANT

TO MAKE. I heard of people that wants to generate constantly +500 pips per month on a

mini account making $3000 per month off an account size of $500. That is there aim.

And the matter of the fact is that it is promoted as if it is obtainable by a lot of the

advertisements floating around. IT IS NOT OBTAINABLE OVER THE LONG RUN.

The fact that one or two big runs producing 500pips in 3days must never be used as a

norm for trading. Your strategy must have an expectancy of steady pips per month

obtained by testing whether it be backwards and or forward.

Papertrading has been a subject of talking where there is mixed feelings as to the

usefulness of it. Some people regards it as a waste of time while others think it is

necessary. I personally regard it as highly needed. I know that it can never simulate the

true circumstances that real trading will give as far as emotion and pressure is concern.

But that is not the purpose I teach people to do papertrading. You will never have the

same emotions as the real thing. What I teach is the rules that needs to be conquered as

far as a certain strategy is concern. I like to do papertrading on a strategy first on history

by back testing the rules to see if it can achieve good results. It is important to include as

much of the market conditions as is possible in your back testing to get reliable results.

This is the easiest part as all the testing is done on hindsight. In this part I compile a

report as to the pip expectancy of the strategy per month and average pips per trade. I also

like to see at what daily time each trade was triggered. That give me an idea of the times I

need to trade to be highly effective for this particular strategy. I can then take the times I

have available per day to trade and then see how many trades were triggered in that times

and what was the amount of pips per month. That will give me a nice expectancy of the

strategy for the times that I can trade. If you know that you can make “X” amount of pips

per month in the times you can trade per day it takes a lot of pressure off. If you don’t

know the expectancy of your strategy then each time you can trade you will be looking

for trades and I can guarantee you it wont be long and you will find a trade. And most of

the time those trades are made on bent rules and that is suicidal. Then I will do some

demo live forward trading to evaluate the strategy in terms of its profitability and to see if

I can stick to the rules of the strategy. At least 30 trades is necessary for the evaluation

period. After that a report must be compiled as far as the percentage of trades done

according to the rules. It must be more then 80% to 90%. If it is less it means that the

rules are not defined good enough or it leaves to much for discretion or the trader did not

use or understand the rules properly.

Only after the 30 trades a live account may be used. And now we come to the

most important part as far as trading is concern. How much do I put on a trade. After

teaching a lot of people I am still amazed at how people just ignore the dangers of the

above statement. It seems that if they have $1000 to start with and it is money they can

effort to lose they go into a gamble sort of made. I spoke to a guy who made $38000 over

a period from a $5000 account and how he throw almost everything away in one night on

one trade. I believe he had his original starting amount left to start again. I never saw how

he got to the $38000 but I can guarantee you that it was also with high risk trading. If you

build up an account to that size using the right risk factors I can guarantee you that you

wont risk it all on one trade. If you can build up an account to a nice size by using the

right risk factors you have a winning recipe. You will then have learned to trade within

tolerable boundaries.

What is the correct risk to use. I always recommend nothing more then 3% of

your total capital at any single or number of trades. If you want to go into three trades

simultaneously then the combined risk of all three trades should not be more then 3%. If

you just start to trade live I suggest a 1% risk until you have a nice flow of positive

money coming in. Then raise that to 2%. I like to sleep well at night if I have an open

position. If you cannot sleep well because of the position you have open then you have

too much at stake, then reduce your position until you will be able to sleep.

Another aspect is that of position sizing. I saw people going into trades with a

fixed lot size(whether micro, mini or full) and then use the 3% to determine there stoploss

size. That to me is also seeking for disaster to struck. Your stoploss need to be at a point

where it is likely that it will not be hit. We will look into that in detail when we do the

actual ingredients of the MLTS.

The way I use it is to determine what my stoploss must be in pip size to have it at

a reasonable place where it will most likely not triggered. One will never be 100% safe

but it needs to be at a reasonable safe place. Then I work out my 3%(or what you feel

comfortable with) of my total capital available and by dividing the stoploss in $value into

my risk will give me my position size for the trade. The bigger the stoploss the smaller

will be my position size and the smaller my stoploss the bigger my position size but no

matter the size of my stoploss I never risk more then 3% of my capital.

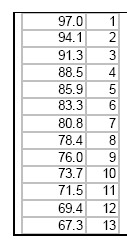

As you can see from the table on the left after 13 wrong trades in a row

you can still have 67% of your account left. That was worked out on a 3%

risk per trade. With 2% you will have way in the 70% over. It just means

that your ability to recover will be much higher after I spell of bad trades.

No one can guarantee that a bad spell of trades wont happen.

The negative comments I get from this approach is that the gains is much smaller

in $ value. That is why I have included the chart on compounding. If you want to risk

more to achieve more gains in terms of $ then you must know that you stand a good

chance to lose a lot. Maybe more then 60% of your account in a relatively short period of

time. The choice is up to you. In our MLTS Example Book I will show you what can be

achieved with a 3% risk/capital over a number of trades.

Let me show you a an example of a trade on different timeframes done with only

3% of capital at risk. You will then get what I am trying to tell you

would be $150 per trade but on different pip size stoplosses of -190,-75 and -9 pips with a

minimum Risk:Reward ratio of 1:1. The position size however differs. On the 5min chart

you can have 1.67 full lot open and the loss will also only be $150. The gain on risk to

reward ratio of one is also $150 per trade. Now you can see that on a daily, weekly,

monthly chart you can get involve. Put your stoploss out of the way and then determine

your position size according to that risking only 3% max.

Look at the 5min chart how the stoploss moves close to the action. That is what

make lower timeframes so difficult to trade. But with the MLTS system we will show

you how you can get involve on a lower timeframe to hop on board a move destined for a

nice run.

What is a good stoploss. If I tell you that the average daily moves of a certain

currency was 100pips over the last 20 days with the highest 200 and the lowest 60 with

more then 70% below 80pips. What would you say was a good stoploss to set that will

give you a highly good chance of not being hit. Especially if the 200pips was after news

and you are now taking a trade with no major news announcements coming out. I think

anything above 100 will be relatively safe. This is in terms of pips how you can

determine a good stoploss.

What if the price just bounced off a strong weekly support line and have traveled

50 pips already. Surely a 60-70 pips stoploss that puts it on the other side of the support

line would be relatively safe

When price takes off after some news announcements you can use history to see

what the movements was just after the same news announcements in the past and what

the behavior was to determine a relatively safe stoploss. At www.forexfactory.com and

their calendar you can find those news in the past with some useful info. You can use that

to get a feel on your charts how the currency pair reacts upon certain news depending on

how much was it better or worse.

The way I describe it is when you are walking in the street and there is a drunken

driver approaching you swinging from one side to the other of the road where will be the

safest way to escape him. That will be to get off the road. Now you can get just off the

road and might be relatively safe as there is a curb that might just prevent him from

getting off the road. How safe is that. It depends on the curb. I think you will get what I

am trying to say. GET OUT OF THE WAY. That is the answer. BUT keep your risk

still within boundaries acceptable to you.

I have also started with tight stoplosses because I did not want to lose to much.

That is the surest way to lose. You have to get out of the action with your stop and

determine your position size according to that and the % you want to risk of your capital.

POINT.

Another way to determine the volatility of the currency is to use the ATR

(Average True Range) and set the setting to one as the graph above. That will give you

the amount of pips that each bar have moved. As you can see the largest candle move for

1Hour was 69pips, and the resent size close to the action was 36pips. That surely can tell

a story about stoploss size.

What currency pairs to watch is entirely up to you. I just believe not to watch to

many. I personally watch the EurUsd, GbpUsd , EurJpy and the UsdJpy. My main pair is

the EurUsd. I believe that there is enough opportunities in just two currency pairs. You

got to know the moods of at least one very well.

Emotional Triggers

Now this a part that I haven’t found written about very much. Only here and there

have I come across some aspects of it. It is quite amazing how our emotions works and

the memory that is build into our emotions due to experiences in the past.

I was about 5years of age when we visited my sister and they had marula trees in

their backyard. Some of the fruit fell from the tree and was lying on the ground. The

problem was that it was lying in the sun. The marula fruit is used to make various kinds

of stuff like, jam, juice, sweets and the most common use marula beer.

Those marula fruit was lying in the sun and they almost become beer themselves

because of the heat. I got very sick and in those days a doctor was only visiting the place

where my sister stayed once a week. It was a real bad experience for me as I was

vomiting a lot.

After that incident my sister moved to another town so I never got involved with

marulas again until about 40years later. I was playing golf in a town we just moved into

and my golf bal landed underneath a marula tree on top of some marulas that was lying

there in the sun as well. It was at this point when I got the smell of the marulas that my

whole body came into reaction. I wanted to vomit. It was a shock to me that I reacted that

way but then I remember the experience I had as a kid. It was an amazing experience to

realize that after 40 years my whole system still remembers that experience. It was as if it

was never gone. That is how real it was.

Why am I telling you this. Because you are going to experience this in your

trading career. I have experienced the same concept while I was trading. I had a few bad

trades with triangle formations and my money management was not good at all so the

loss was hurting. After that I did not like trading triangles at all. My mind seemed to cut

them out. I did not even recognized them. I had to make a point of it to see them and

study them again just as I took a marula fruit and carry it with me and smell it and force

myself to get use to it I had to do that with triangle formations.

That is what is meant by “I just cannot pull the trigger”. Have you been at that

stage. You see everything in front of you lining up and begging to pull the trigger but

there is that force that keeps you from doing it. That force is the emotional memory of a

bad experience in the past. It is amazing that the events in front of you don’t even have to

be exactly the same as the bad experience. If there is just a portion that is similar to the

original event it recalls the same emotion that was experienced at that time. You will

make a trade and somehow you don’t feel good about it. It might be that you had a

similar sort of trade in the past that turned out negative. You might not even remember it

but your emotions are triggered to what you smell, hear, see, taste etc. Even the place

where you trade might be a trigger if you start off badly.

I am not telling you this to scare you but to make you aware of the fact that you

will experience those feelings. The main thing is how can you overcome that. I carried a

marula fruit in my pocket first, then after some time a could smell it and at some stage I

could even taste it a bit. But I could never come to the point as to eat one.

The main way to overcome that is to know the results your system has given in

the back testing as well as forward testing and the knowledge that you WILL have bad

patches. Every system goes through that. If you have 30 or more live results and that is

way below the testing results you have to reassess the whole process as to the accuracy of

your execution according to the rules of the strategy. If the market conditions have

changed in such a way that it does not suit your strategy anymore it only means that the

period of time the back testing was done did not include most market conditions. You

have to do your back testing to simulate a wide range of market conditions to get a real

reliable result.

Perfect Landing

This is a section I like very much. This is the heart of my trading especially when

it comes to stocks. This was done for my stock trading but some of it can be used for

forex trading as well. I have called it perfect landing because before you have landed and

closed a trade it means nothing as long as it is still open. Unless you have secured some

profit with your stoploss set above your entry point so that you cannot lose on the trade.

I made myself a routine checklist that starts at a point and ends at a point. That

helps me to ensure that I don’t miss something. I am not going to go into detail with it but

will give you an outline so that you can built your own. It might look like a waste of time

but just read through it so that you at least get the concept that I am trying to convey.

With time I don’t look at this very often anymore because it has become part of me. It is

like walking over a busy street for the first time. The first time I am sure there will be

some rules written down and looked at often but with time and many crosses according to

the rules as you approach the road your sensors will pick up the motion and because of

the experience you will know the safety factors of crossing without looking at the rules.

But over time we get slack and start to take chances. Be aware of incidents. If an incident

occur just check your checklist again and make sure you were within the boundaries. If

not then take corrective action.

Here is a portion of my checklist.

A pilot arrive at work and are given 5 different options. There is 5 different

aircrafts each with its own cargo and destiny. He have the choice as to which one of the 5

he wants to take. The reward for a safe cargo offloading also differ on all 5 options. He

now has to make a choice. There is certain procedures he has to go through. There might

be a lot more as I am not a pilot but this is what I have set to myself.

You wont understand most of columns 2 3 and 4 but I want you to look at column one. It

gives you a sequence of events.

A. Flightschedule

To fly or not to fly. Does the overall weather allow takeoff. To choose the

aircraft and destination and reward according to his experience and

qualification is vital.

1. When you start the day the market will tell you if it is good for

trading or not as well as news that might come out for the day like

Nonfarm Payrolls and Interest rate decisions etc. Make sure if the

day will be a tradable day.

2. Then choose the right tools and strategy to trade the situation.

B. Pre Inspection

Weather report of the route that is going to be taken.

1. What might influence the trade like news, do you have to go

somewhere leaving the trade open etc.

To be aware of difficulties as far as the weather is.

Are there emergency landing places on the route. Do you have their coordinates.

1. Do you have your exit point set. Do you have your stoploss set.

What if it gaps through your stop. What plan do you have in place

if that happens. Especially if you are not in front of your computer.

Preparing for takeoff.

1. Make sure everything is set and in place to place the order.

C. Runway

Approaching the runway

1. Give yourself enough runway time. What I mean don’t come and sit

in front of the computer and take off and make the trade without

proper preparation. That way you will miss some checkpoints.

2. Always have an overall awareness of what is going on around you

with other currency pairs as well. An early move on another

currency that are related to the one you want to trade might just

stop or confirm your position.

Make sure that conditions is still OK.

1. The same as previous point. Make sure you give yourself enough

time to monitor that.

D. Take off

Pull the throttle at the right time.

1. Don’t be caught in the movement of the moment and pull the

trigger before your setup is complete. Let it go to the point of

entry as you have set it.

2. NO DISTURBANCE. That is vital at this point.

Have an emergency plan in case something went wrong.

1. Internet downtime. Emergency at home. Telephone call. Nature

calls etc. Always have an emergency stoploss in place.

E. In flight

Keep an eye on weather changes

1. Price might suddenly turns around due to bad news. Know your news

calendar and what the outcome of news during your trade might be

if it turns bad. History of that specific news will reveal what price

action to expect if it is worse then expected and also if better

then expected news is reported. That might cause you to lift

you’re your profit target.

Watching the gauges

1. If you are not an absolute expert don’t have to many gauges as

that might influence your decision making. I don’t like indicators

to decide the outcome of my trades. Price action within a preset

of boundaries determines the outcome. That might change as the

trade goes on but only to the profit side. The stoploss is fixed

and NEVER lowered.

Breakfast in flight.

1. Some like to take some profit after some movement in positive

territory. I use to do that a lot but with the MLTS it has become

much less. Only if the price does not reach my target and starts

to hover below the target I might close a 60%portion and set the

remainder on autopilot.

Autopilot

1. If price are close to my target and I have to leave the computer

I might pull in my stoploss and put it on a trailingstop. Because of

the different timeframes you can trade the MLTS when doing

the larger timeframes you don’t have to be in front of your

computer at all. All is preset and left to play out. Intervention

then only occur when there is a climate change. But on the

smaller timeframes computer time have to be part of it. But

because the larger timeframes are used in the trade plan the

advantages of the higher timeframes will very soon be realized.

Destiny in sight

1. When the profit target is approached what is your plan.

2. Are you going to take full or partial profit

3. What if the price turns short of the profit target. What is the

plan of action.

F. Landing preparation

Weather scan

1. If your target is reached with a sudden up move it could be

because of good news. Then you don’t want to take profit as you

want to give it more chance to develop. Check if you could see

what created the move and what could be the extend of it.

G. Landing

Throttle down

1. When all is set according to plan then pull the trigger and close

the trade.

H. Flight Report

The right and wrongs

1. Report the right and wrongs that was done on the trade. Was the

trade according to the rules etc.

Positive and negatives

1. What was the positives and negatives of the trade. How did you

experience the trade.

Optimizing

1. Could the trade be optimized and produced more pips. This is

important for future trades as to not close trades prematurely.

Post therapy

1. Write down your feelings during the trade and what was the

reasons behind the feelings. Work out a plan to handle and manage the bad

feelings.

1 comments:

Your style of presentation is very impressive. The meaningful contribution of your mind reflects on those people who are looking for new ideas and informations regarding trading systems. I would like to tweet on it and keep spying at every moment you blogging. Thanks...

Day Trading Strategy

Post a Comment