The Method:

The main aim of this strategy is to allow the user to use

1 min strategy price chart and enter at predefined areas determined

when the trader starts his/her day of trading on different

currency pairs.

This 1 min strategy ASR strategy (ASR-Attacking Support and

Resistance) has the advantaged that those areas will be

known beforehand and is only entered when the specific area

are approached and the setup criteria is met.

The amount of pips obtainable with the ASR are in the region

of 10-100pips depending on the strength of the move

especially when it is news driven. The trader will also know when to close the trade.

This also fits nice into the MLTS as discussed up to now. If

you have missed a trade in the MLTS you can always

captures some pips as the price moves towards the Profit

Target using the1 min strategy to attack that level. The main thing to

take into account is that the Risk:Reward must never be less

then 1:1. As long as that ratio is maintained you will make

money.

Never use more then 1,5% of your capital as

risk with the 1 min strategy ASR strategy until you are

comfortable trading it.This 1min strategy also satisfy the need for trading. We are human and

when we sit to trade we want to trade. Patience is one of the destroyers of an

account. We don’t want to wait so we look for trades and get burned more

then often. This 1 min strategy gives us the opportunity to satisfy that

need while our risk remains small enough not to get wiped out.

This strategy is exactly what the title is saying. It is all about

determining some support and resistance levels and then to attack

those levels. It differs in the sense that we are not going to trade off

the support and the resistance but rather towards them.

That means that we are going to determine before the day

starts where support and resistance is likely going to occur. Then we mark a

price range 30-50 pips away from the support/resistance.

What we are then looking for is for the price to move into that price range

and then we look at the 1 min strategy chart to enter at a certain setup we will discuss

later on. We then stay in the trade and exit the trade according to the rules as

explained later.

We are going to use a 4hour chart to determine the support

and resistance levels that might be tested and then mark our areas,

then change to the 1 min strategy chart and WAIT for action.

All indicators used is standard indicators found in most

software used for trading Forex. We can make use of an alert setup

to warn us when the price is nearing the marked area so we don’t

have to be in front of the computer all the time. We can be in the

vicinity doing other things and only draw closer when the alert goes

off. We then watch for the setup and finish the trade according to the rules.

We also don’t want to overtrade by watching to many pairs and

entering to many trades. I have only used the EurUsd and the

GbpUsd and I will decide on one of the two when the trading area is approach.

Sometimes the EurUsd will be there first and sometimes the GbpUsd first. I

have tried to only trade 3 trades per day.

You as a trader may test this on any pairs you would like to trade as the

support and resistance levels works the same for all pairs.

The INGREDIENTS:

On a 4H chart plot the following Moving Averages

1. 200 simple moving average

2. 89 simple moving average

3. 21 exponential moving average

On a 1 min strategy Chart plot a 34 simple moving average

If you haven’t watch the video yet please do so now before going

further.

Please copy this link to your browser to play back your recording:

http://www.gatherplace.net/play?25198708

Recording Name: 4Hour Rhythm

THE METHOD:

Now for the method to determine the support/resistance we

must understand the role the 3 moving averages are playing in the

4Hour timeframe. You will find that the price is finding support and or

resistance on and against these moving averages quite amazingly.

Lets look at some examples of it.

If you look at the chart you will notice how many times have the price

moved towards those moving averages. This is where the key to this

strategy is nested. Because the price is going to those moving

averages very often we can mark a price area 30-50pips away from

those moving averages and then use the 1 min strategy to enter a trade with

our initial profit goal round about the moving average. At this stage I only

want you to see the potential of the price moving towards those

moving averages as I have not marked everyone on the chart included.

The idea was not to show every move towards

support/resistance in the examples but rather to gave you the idea of

the concept.

Lets do some more examples

Example 1:

Here you can see that the price is moving towards the moving averages

quite often in a span of 4 weeks. That creates opportunities for trading

using the 1 min strategy ASR strategy

Example 2:

Here is a video link to the 1 min strategy ASR strategy that you can watch

Please copy this link to your browser to play back your recording:

http://www.gatherplace.net/play?47083658

Recording Name: 1Min ComboBox

A. The downtrendline was broken and the odds were good for

the price to move towards the 21ema creating an opportunity

for a long trade

B. When the price reached an area with the price rising just

below the 21ema the signal candle as well as the previous red

candle had tails on them creating a possibility of a retest of the

21ema. An area of 30-50 pips could be marked for a possible

trade.

C. The price formed an inverted red hammer and when the price

moved above the high of that hammer (brown horizontal line)

the odds were high that the price might move up to the 21ema

once again creating an opportunity to trade.

D. After a huge bullish candle the odds were high that the 89sma

might be tested creating yet another opportunity to trade.

E. With the price moving above the 89sma we know that the

price very often comes back to retest the 89sma and when that

tail was busy forming the odds were good that the 89sma

might be tested creating 1 min strategy ASR trade opportunity.

F. Here we had a doji candle as well as a shooting star

indicating a possible downmove which creates ones again an

opportunity for an ASR trade down to the 89sma.

By now you must have grasped what there is to look for when

using the moving averages as support and resistance and the

marking of the areas.

It is very important also to recognize the candle emotion prior to

the signal candle like hammers, morning/evening stars,

shooting stars, bullish/bearish engulfing etc. to determine the

intension of the move to go the way as anticipated.

Sometimes there are barriers for the price to overcome to be able to

reach the desired moving average as anticipated. And they are equal

price levels like 1,3500--1.2900—1.4000 etc. They play a major role as

the price will try to find support and or resistance at those levels as

well. When these price levels are in the way to a moving average the

trader must take that into account that the price might turn around at

those levels or stay there for some time before getting direction again.

Therefore when in a trade then take caution by either securing a non

loss situation by moving the position to breakeven or move the

stoploss to a profit exit at least should the price turn around.

Another barrier are trendlines. Trendlines of supp/res in the way to a

moving average must also be taken into account. Those trendlines

also act as possible profit taking zones. Trendlines is also

oppertunities for some ASR trades.

trades. Points 1 to 5 is necessary for the trendlines to be defined and

cannot act as possible areas.

See if you can spot some other areas around the different moving

averages as discussed previously on this same chart and see for

yourself how many opportunities does occur and if traded how many

trades can be made.

what happens on the 1 min strategy chart at those levels.

levels before getting direction. Thos red marked areas

But here we have another opportunity coming our way and that is if the

price have a high probability to move to the 4Hour 200sma and

there are some price levels in between we can marked those areas

just as the chart below indicates giving us another 1 min strategy ASR

entries.

down to the 200sma on the 4Hour

crossing 3 price levels each one

creating an opportunity to have a

1 min strategy ASR trade. The last 30-50

pips approaching the price level

are ideal to have an area marked

as indicated on the 1min chart

giving as ASR trade

opportunities.

At area marked B you can see how the price is interacting at the price

levels before getting direction. That red marked area

But now we come to the meat of the 1Min Attacking Support and

Resistance levels and that is the Entry, Stoploss and Exit rules.

Entry, Stoploss and Takeprofit:

The entry is based upon an old entry method called the 123 method.

When the price are at the marked area we start to look for a 123 setup to

form and enter the trade on that bases.

As you can see on the chart below that in a 123 setup point no 3 must be

lower then point 1 for a short trade and the price have to surpass point

2 for point 3 to be formed. Entry is made when the 1 min candle closes

below point 2. Take profit depends on the speed of the market but the

34sma acts as a very good place to close the trade should it being

breached.

success of the method is the determination of the areas and needs

some practice.

The entry, exit and profit taking setups for a long entry is just the inverse

of what is described on previous page.

We will now move to some examples of trades and areas marked.

In the example below the anticipation was for the price to bounce off the

bottom trendline and to go to the 21ema on the 4Hour. That area is

then marked on the 1Min chart as indicated on the right hand chart

and entry was made according to our 123 method and take profit was

when the price crosses below the 34simple moving average.

Some more examples of entry, stoploss and exit trades.

The following few pages will show some areas marked as described

combining moving averages, trendlines and price levels.

As you can see that by premarking the trade opportunity areas there is

plenty trades to be made on a weekly basis.

This 1min strategy also satisfy the need for trading. We are human and

when we sit to trade we want to trade. Patience is one of the

destroyers of an account. We don’t want to wait so we look for trades

and get burned more then often. This 1min ASR strategy gives us the

opportunity to satisfy that need while our risk remains small enough.

Now that you have worked through this you can see how this method can

also be used to Premark the areas using the Fib retracements and or

extensions on the 4Hour and even Daily charts as discussed on the

MLTS. There are plenty of opportunities to trade this method.

READ MORE - 1min strategy Attacking Support and Resistance

The main aim of this strategy is to allow the user to use

1 min strategy price chart and enter at predefined areas determined

when the trader starts his/her day of trading on different

currency pairs.

This 1 min strategy ASR strategy (ASR-Attacking Support and

Resistance) has the advantaged that those areas will be

known beforehand and is only entered when the specific area

are approached and the setup criteria is met.

The amount of pips obtainable with the ASR are in the region

of 10-100pips depending on the strength of the move

especially when it is news driven. The trader will also know when to close the trade.

This also fits nice into the MLTS as discussed up to now. If

you have missed a trade in the MLTS you can always

captures some pips as the price moves towards the Profit

Target using the1 min strategy to attack that level. The main thing to

take into account is that the Risk:Reward must never be less

then 1:1. As long as that ratio is maintained you will make

money.

Never use more then 1,5% of your capital as

risk with the 1 min strategy ASR strategy until you are

comfortable trading it.This 1min strategy also satisfy the need for trading. We are human and

when we sit to trade we want to trade. Patience is one of the destroyers of an

account. We don’t want to wait so we look for trades and get burned more

then often. This 1 min strategy gives us the opportunity to satisfy that

need while our risk remains small enough not to get wiped out.

This strategy is exactly what the title is saying. It is all about

determining some support and resistance levels and then to attack

those levels. It differs in the sense that we are not going to trade off

the support and the resistance but rather towards them.

That means that we are going to determine before the day

starts where support and resistance is likely going to occur. Then we mark a

price range 30-50 pips away from the support/resistance.

What we are then looking for is for the price to move into that price range

and then we look at the 1 min strategy chart to enter at a certain setup we will discuss

later on. We then stay in the trade and exit the trade according to the rules as

explained later.

We are going to use a 4hour chart to determine the support

and resistance levels that might be tested and then mark our areas,

then change to the 1 min strategy chart and WAIT for action.

All indicators used is standard indicators found in most

software used for trading Forex. We can make use of an alert setup

to warn us when the price is nearing the marked area so we don’t

have to be in front of the computer all the time. We can be in the

vicinity doing other things and only draw closer when the alert goes

off. We then watch for the setup and finish the trade according to the rules.

We also don’t want to overtrade by watching to many pairs and

entering to many trades. I have only used the EurUsd and the

GbpUsd and I will decide on one of the two when the trading area is approach.

Sometimes the EurUsd will be there first and sometimes the GbpUsd first. I

have tried to only trade 3 trades per day.

You as a trader may test this on any pairs you would like to trade as the

support and resistance levels works the same for all pairs.

The INGREDIENTS:

On a 4H chart plot the following Moving Averages

1. 200 simple moving average

2. 89 simple moving average

3. 21 exponential moving average

On a 1 min strategy Chart plot a 34 simple moving average

If you haven’t watch the video yet please do so now before going

further.

Please copy this link to your browser to play back your recording:

http://www.gatherplace.net/play?25198708

Recording Name: 4Hour Rhythm

THE METHOD:

Now for the method to determine the support/resistance we

must understand the role the 3 moving averages are playing in the

4Hour timeframe. You will find that the price is finding support and or

resistance on and against these moving averages quite amazingly.

Lets look at some examples of it.

If you look at the chart you will notice how many times have the price

moved towards those moving averages. This is where the key to this

strategy is nested. Because the price is going to those moving

averages very often we can mark a price area 30-50pips away from

those moving averages and then use the 1 min strategy to enter a trade with

our initial profit goal round about the moving average. At this stage I only

want you to see the potential of the price moving towards those

moving averages as I have not marked everyone on the chart included.

The idea was not to show every move towards

support/resistance in the examples but rather to gave you the idea of

the concept.

Lets do some more examples

Example 1:

Here you can see that the price is moving towards the moving averages

quite often in a span of 4 weeks. That creates opportunities for trading

using the 1 min strategy ASR strategy

Example 2:

Here is a video link to the 1 min strategy ASR strategy that you can watch

Please copy this link to your browser to play back your recording:

http://www.gatherplace.net/play?47083658

Recording Name: 1Min ComboBox

Lets look at areas marked A – F individually.

A. The downtrendline was broken and the odds were good for

the price to move towards the 21ema creating an opportunity

for a long trade

B. When the price reached an area with the price rising just

below the 21ema the signal candle as well as the previous red

candle had tails on them creating a possibility of a retest of the

21ema. An area of 30-50 pips could be marked for a possible

trade.

C. The price formed an inverted red hammer and when the price

moved above the high of that hammer (brown horizontal line)

the odds were high that the price might move up to the 21ema

once again creating an opportunity to trade.

D. After a huge bullish candle the odds were high that the 89sma

might be tested creating yet another opportunity to trade.

E. With the price moving above the 89sma we know that the

price very often comes back to retest the 89sma and when that

tail was busy forming the odds were good that the 89sma

might be tested creating 1 min strategy ASR trade opportunity.

F. Here we had a doji candle as well as a shooting star

indicating a possible downmove which creates ones again an

opportunity for an ASR trade down to the 89sma.

By now you must have grasped what there is to look for when

using the moving averages as support and resistance and the

marking of the areas.

It is very important also to recognize the candle emotion prior to

the signal candle like hammers, morning/evening stars,

shooting stars, bullish/bearish engulfing etc. to determine the

intension of the move to go the way as anticipated.

Sometimes there are barriers for the price to overcome to be able to

reach the desired moving average as anticipated. And they are equal

price levels like 1,3500--1.2900—1.4000 etc. They play a major role as

the price will try to find support and or resistance at those levels as

well. When these price levels are in the way to a moving average the

trader must take that into account that the price might turn around at

those levels or stay there for some time before getting direction again.

Therefore when in a trade then take caution by either securing a non

loss situation by moving the position to breakeven or move the

stoploss to a profit exit at least should the price turn around.

Another barrier are trendlines. Trendlines of supp/res in the way to a

moving average must also be taken into account. Those trendlines

also act as possible profit taking zones. Trendlines is also

oppertunities for some ASR trades.

Look how trendlines can be used to marked areas for possible ASR

trades. Points 1 to 5 is necessary for the trendlines to be defined and

cannot act as possible areas.

See if you can spot some other areas around the different moving

averages as discussed previously on this same chart and see for

yourself how many opportunities does occur and if traded how many

trades can be made.

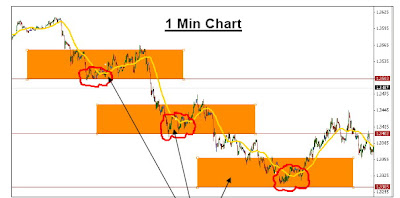

In the next chart the areas was marked and we will look in more depth

what happens on the 1 min strategy chart at those levels.

At area marked A you can see how the price is interacting at the price

levels before getting direction. Thos red marked areas

But here we have another opportunity coming our way and that is if the

price have a high probability to move to the 4Hour 200sma and

there are some price levels in between we can marked those areas

just as the chart below indicates giving us another 1 min strategy ASR

entries.

4 Hour Chart As you can see that the price went

down to the 200sma on the 4Hour

crossing 3 price levels each one

creating an opportunity to have a

1 min strategy ASR trade. The last 30-50

pips approaching the price level

are ideal to have an area marked

as indicated on the 1min chart

giving as ASR trade

opportunities.

At area marked B you can see how the price is interacting at the price

levels before getting direction. That red marked area

A lot of pages just to get the concept of the areas under the belt.

But now we come to the meat of the 1Min Attacking Support and

Resistance levels and that is the Entry, Stoploss and Exit rules.

Entry, Stoploss and Takeprofit:

The entry is based upon an old entry method called the 123 method.

When the price are at the marked area we start to look for a 123 setup to

form and enter the trade on that bases.

As you can see on the chart below that in a 123 setup point no 3 must be

lower then point 1 for a short trade and the price have to surpass point

2 for point 3 to be formed. Entry is made when the 1 min candle closes

below point 2. Take profit depends on the speed of the market but the

34sma acts as a very good place to close the trade should it being

breached.

Price have to surpass point 2 for point 3 to be formed

Quite surprised that the meat of the system is merely one page. The whole

success of the method is the determination of the areas and needs

some practice.

The entry, exit and profit taking setups for a long entry is just the inverse

of what is described on previous page.

We will now move to some examples of trades and areas marked.

In the example below the anticipation was for the price to bounce off the

bottom trendline and to go to the 21ema on the 4Hour. That area is

then marked on the 1Min chart as indicated on the right hand chart

and entry was made according to our 123 method and take profit was

when the price crosses below the 34simple moving average.

Some more examples of entry, stoploss and exit trades.

The following few pages will show some areas marked as described

combining moving averages, trendlines and price levels.

Conclusion:

As you can see that by premarking the trade opportunity areas there is

plenty trades to be made on a weekly basis.

This 1min strategy also satisfy the need for trading. We are human and

when we sit to trade we want to trade. Patience is one of the

destroyers of an account. We don’t want to wait so we look for trades

and get burned more then often. This 1min ASR strategy gives us the

opportunity to satisfy that need while our risk remains small enough.

Now that you have worked through this you can see how this method can

also be used to Premark the areas using the Fib retracements and or

extensions on the 4Hour and even Daily charts as discussed on the

MLTS. There are plenty of opportunities to trade this method.