The market has a rhythm that if recognized can make trading so much easier. It is

something that must be learned over time and take a while to master. But when that is

achieved the resulting effect on trading is enormous. So look at the next video and make

sure you understand the concept. That will also help you to stretch some profit targets

when trading the MLTS. You can set the moving average as the profit target if that is

better then the Secondary level Profit target. When the secondary level profit target is

breached the moving average according to the market rhythm will then be the next target.

Please copy this link to your browser to play back your recording:

Recording Name: 4Hour Rhythm

These videos are not part of the selling price but were added as a bonus. They

are hosted on the www.gatherplce.net servers and are therefore depended

on their server availability as well as server loads. Check your firewall

settings in case of difficulty viewing. We have found some overload at times.

Just try again. Sometimes the video starts without voice. Just exit and retry

again. The videos have been tested and they are working when all is going well.

SOME CAUTION

I have to tell you this. The smaller the timeframe is used the more false breakouts

occur. As we are trading breakouts in the direction of the overall market condition

the smaller the timeframe the more percentage false breakouts occur. I have

spoken to some hedge fund traders and they do hunt stops. That is what I have been told.

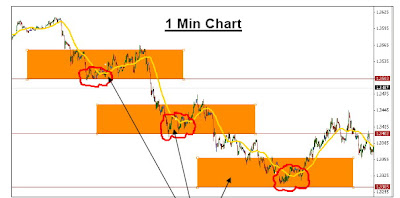

There is however a very good way to trade these false breakouts. I will show a few. If this approach is traded the success rate is very high although much less trades.This is how it works.

1. We don’t take any breakout trades. We wait for a pullback into the pattern (in

our example a triangle) and enter at point “a” with our stoploss at point “b”.

2. The stops of those that took the breakout trade is normally at point 1,2 or 3

depending on how aggressive or conservative they approach the trade.

Sometimes there will only be one stoploss place and sometimes there will be

two. We will look into some examples later on.

3. Our take profit targets is set at those stoploss places that are under attack.

4. Our Risk:Reward ratio needs to be at leas 1:1.2 minimum.

5. First determine the stoploss size and then determine if we can get a R:R ratio

that is better then 1:1 to the stoploss placement of those that took the breakout trade.

6. Secure a breakeven situation as soon as 50%-60% of profit target is reached.7. If the speed is quick and it goes on then ride the tide or take some profit after 50%-60% and give the remainder a chance to ride. Waiting for a news announcement and there was an attempted break to the

downside before the news and must not be seen as a false breakout but rather an attempt

to get the trigger happy to enter before the time. The real breakout came at the black

arrow with the stops most likely at no 1, 2 or 3. Then the price retraced back into the

pattern with our entry at “a”, stop at “b” and profit target at “c”. Stoploss 2 and 3 falls

outside our 1:1 risk/reward ratio therefore we only have one profit target and that is at

stoploss number 3. Look how the price tested the upper trendline exactly and then break

the bottom trendline. That is now the correct direction as the hunting was over and now

you can enter and use the gain you made as a stoploss.

That was a 25pip up gain and a 30pip down gain.

Profit target was reached with the Multi Level System as discussed.

Look at this setup. 25Pips trading the hunting and 40pips trading the MLS after the true

breakout.

Another handing out of balls just to collect them again. They can see the depth of

orders and they knew that there were some orders at the bottom of the channel and

price will always move to where the demand is lying. They were not worried as there

stops are way below the bottom channel. If you see something like this on a 4Hour chart

you know that there is something big coming and you can position yourself to take

advantage of it.

breakout.

Another handing out of balls just to collect them again. They can see the depth of

orders and they knew that there were some orders at the bottom of the channel and

price will always move to where the demand is lying. They were not worried as there

stops are way below the bottom channel. If you see something like this on a 4Hour chart

you know that there is something big coming and you can position yourself to take

advantage of it.

Look how there was two attempts of a breakout at “Z”. Stops was most likely at

“X” and “Y”. There were breakout orders picked up on 2 occasions and both stoploss

levels were taken out. That was a golden opportunity to get some hunting pips in the bag.

1hour chart

1hour chartCaution

Look for patterns that has some sort of length in terms of candles. Don’t use a short

pattern formed over only a few candles. Give it a fair chance to build up.

This pattern on the 15min chart is worth 13pips so don’t even consider it. Make sure you

This pattern on the 15min chart is worth 13pips so don’t even consider it. Make sure youhave enough pips to have a fair chance and if there is a lot of emotion build into the

pattern formed over some time. There is no rule to determine that. With time you will see

the building up and know that they might do some shaking out. If you spot one on the

1hour it is worth looking at it on the 15min as your secondary level setup and take it from

there trying to get the hunting portion as well as the true breakout part.